An incredibly proud moment for me as Aruwa Capital releases its inaugural impact report to mark our fifth-year anniversary. As I reflect on the last five years, I am filled with nothing but gratitude as to how far we have come as a firm in a short space of time. It’s been five years of making impactful and meaningful investments that are driving positive change and reshaping the investment landscape in Africa.

It was a pleasure to join one of the panels on the insightful webinar hosted by MiDA Advisors and Standard Bank Group to discuss a critical topic, “Invest in Africa- The time is now” where I discussed Aruwa’s gender lens investment strategy and its trickle-down effect on gender diversity across the value chain of businesses we invest in. I also emphasized our focus on investments in proven businesses that are at a pivotal point of their growth and how Aruwa is providing the much-needed growth capital to help them scale up. The panel expertly moderated by Thembi Matabiswana, Senior Consultant at Riscurra, included other trailblazing fund managers across the continent- Jesmane Boggenpoel, Co-founder & Managing Partner- AIH Capital, and Sheila Kyarisiima, Partner - NISK Capital.

Thrilled to have represented Aruwa Capital at the Power Africa Nigeria Power Sector Program Investor Matchmaking event hosted by USAID. The event aimed to bridge the gap between investors and developers in the on-grid and off-grid space. It was an honour to present Aruwa Capital’s investment strategy as well as our criteria for investing in the renewable energy sector.

Thrilled to have joined one of the panels at the recent Kreston Pedabo breakfast seminar. The event was themed 'Unlocking Financial Potential: Funding Opportunities for Nigerian Businesses,' a topic that resonates deeply with me. My panel was tagged- Capitalizing Growth: Navigating the Financial Landscape for Business Success in Nigeria. It was an enriching experience to exchange ideas alongside industry leaders such as Albert Folorunsho, Managing Consultant at Kreston Pedabo, Gbadebo Adenrele, MD Investment Banking at United Capital Plc, Abolore Solebo, Executive Director at Fidelity Bank PLC.

I had the pleasure of joining a webinar hosted by the Tuck School of Business in Dartmouth as a panelist. The webinar was tagged- Doing Business in Africa, and my panel discussed a significant topic- Making profit sustainable and sustainability profitable. The panel was moderated by Oruare Ovbiagele, a Centre for Business, Government and Society Fellow at Tuck. It was an insightful panel which had notable speakers in attendance, and we shared unique perspectives on reshaping the narrative of doing business in Africa.

Excited to announce my new role as a Board of Trustee member at United Way Greater Nigeria, affiliated with United Way the world’s largest non-profit organisation with a network of over 1,800 affiliates globally. United Way Greater Nigeria (UWGN) is dedicated to addressing critical societal challenges in education, youth productivity, women's empowerment, and food security. Our collaborative efforts aim to enhance UWGN's capacity to make a tangible difference in the lives and communities of Nigeria.

I am honoured to have been recognized at the 2024 Eloy Awards as one of the 50 power people who embody resilience, leadership & advocate for women’s empowerment and inclusion in Africa. The list was put together in collaboration with Eloy Foundation, Africa Women CEOs network and powered by Exquisite Magazine.

It was a pleasure to join the Mentor Intro Africa IWD webinar hosted by Fola Niyi- Duale, Founder/CEO Mentor Intro Africa with the theme- She breaks barriers: Empowering Women through Mentorship. I joined two other amazing women- Adaku Ijara, MD/CEO Emerging Africa Asset Management Limited and Hauwa Shakir, CEO of Kulu Abuja. I discussed the transformative power of mentorship using insights from my personal and professional journey.

It was great to attend the ImpactHer International Women’s Day event themed “Inspire Inclusion: Unlocking Opportunities Using Digital Skills and Market Expansion”. I had the pleasure of joining the keynote panel session where we discussed the urgent need for technological adaptation, and the critical importance of integrating technology into daily business operations particularly for women. I was honoured to speak alongside notable women like- Oluwatoyin Aralepo Director of Finance at Mastercard Foundation, Adaku Ijara, MD/CEO Emerging Africa Asset Management Ltd., Dr Oluseyi Olanrewaju, CFO Digital Reality, Onyeche Elisabeth Agbiti-Douglas, Project Manager, BRAVE Women Nigeria, the session was moderated by Ayishat Olanrewaju, Founder, Corporately Lucid.

It was a pleasure to join host- Nsembo Udoh on the Hub one Insider Series webinar hosted by FCMB with the topic- Raising Investment Amid VC Funding Crunch, where I shared tips on how to overcome obstacles posing challenges for founders seeking funding and how to navigate the current VC crunch and winter.

It was a pleasure to join the webinar hosted by Mastercard Foundation Africa Growth Fund in celebration of International Women’s Day with the theme- Inspire Inclusion hosted by Vymala Thuron, Deputy MD, MFAGF. I was honoured to speak alongside other female fund managers- Joyce-Ann Wainana, Managing Partner, Chui Ventures, Nneka Eze, Managing Partner, Vested World, Kim Kamarebe, Managing Partner, Inua Capital. Together we addressed pressing questions about the progress of gender equity in impact investing, sharing insights from the perspective of our respective journeys.

I was honoured to have been invited by Aelex Law Firm to speak at their in-house event celebrating International Women’s month. I had the pleasure of sharing my journey from my early years to starting my professional investment banking journey and how that led to founding Aruwa Capital. It was an uplifting event with a warm atmosphere where we could have open and heartfelt discussions.

I had the pleasure of joining host- Tochukwu Ezekuwu, Regional Director, Avpa and fellow panelist- Dr. Ola Brown, Founder, Health Cap on the African Venture Philantrophy Alliance webinar tagged- ‘What the Data and Trends Say, And What They Mean For Funding Flows And Venture Builders’. We had an eye-opening and impactful session which focused on crucial data and trends affecting investment decisions, especially in West Africa.

I had the pleasure of joining one of the panels at the Pension Fund Operators Association of Nigeria (PENOP) IWD Celebration with the theme: Inspire Inclusion. The panel which was moderated by Adaobi Okoye was tagged – ‘Driver’s Seat: The Role of Women in Digital Transformation’ had esteemed speakers in attendance – Olayinka Ajayi, Executive Director, Zenith PFC, Nike Bajomo, Executive Director, Stanbic IBTC PFA, Ugochukwu ‘Ugodre’ Obi-Chukwu, Founder and CEO Nairametrics.

I had the pleasure of being a panelist at the Nigerian British Chamber of Commerce’s IWD celebration themed - ‘Invest in Women: Accelerate Progress’. My panel which was expertly hosted by Rolake Akinkugbe-Filani comprised of noteworthy individuals- Adeniyi Adekoya- Deputy MD of Snyperpet and Weston Limited, and Kemi Awodein, MD of Investment Banking at Chapel Hill Denham discussed a powerful topic - ‘Empowering Women in Finance’ where we explored ways we can continue to champion women’s voices and drive meaningful change.

I am honoured to have been featured in an article written by Claudia Cahalene for Impact Entrepreneur. The article titled- Capital for Her: Investing in Women Entrepreneurs in Africa Wins highlights my journey from Investment banking to founding Aruwa Capital Management, Aruwa’s track record and fund II plans, our investment strategy and the socio-economic ripple effect of investing in women.

I had the pleasure of moderating one of the panels at the 2nd Annual PEVCA Nigeria conference with the theme: The Next Frontier: Private Capital Opportunities in a Shifting Economic Landscape. The panel -Planning for successful exits and performance had esteemed speakers in attendance – Nnenia Ejebe, Partner Adenia Capital, Laolu Alabi, Senior Vice President, African Capital Alliance, Mobolaji Adeoye, Founder and Managing Partner, Consonance Capital and Daniel Adeoye, Partner Verod Capital.

I am humbled to be recognized as one of the Ventures Africa 20 women of impact for the year 2023. This recognition highlights women who have displayed outstanding leadership and also contributed to community building, economic empowerment, leadership, innovation and societal change.

I am grateful and humbled to have emerged as the 2X Global Woman Fund Manager of the Year in 2023 at the Informa SuperReturn Africa conference in Cape Town. The award is a testament of how Aruwa Capital Management stands as a beacon of hope for female fund managers and female entrepreneurs across Africa. Thank you to 2X Global for the recognition and honour. I am so grateful to everyone that has joined me in this journey so far, the best is yet to come.

It was great to attend the Gender Champion Meeting hosted by the African CEO Gender Forum themed “Pioneering change: The Female Champions Driving Africa’s Success”. I had the pleasure of moderating of the panel sessions tagged- “Breaking into the Boys Club: Navigating Male-Dominated Environments” where I shared my experience founding Aruwa Capital at the age of 29 and navigating a male dominated industry. I was honoured to speak alongside notable women like- Dr. Ngozi Okonjo-Iweala (DG World Trade Organization) Dr. Ola Brown (Founder Health Cap) Lucy Quist (Author and Founder, The Bold New Normal) etc.

I am truly honoured to have been named among the Choiseul Africa 100 Africa laureates for the second consecutive year 2023. Recognized as one of the 100 young African leaders aged 40 and under who are playing pivotal roles in Africa's economic development, this recognition reflects the immense opportunities that our beloved continent, Africa, presents to its young leaders. I am proud to be among the 10 Laureates from Nigeria who made the top 100 list for 2023.

It was a pleasure to join host- Frank Aswani CEO AVPA and Bernard Chidzero, Snr. Investment Advisor Bridgespan on the webinar hosted by African Venture Philanthropy Alliance (AVPA) in collaboration with the Bridgespan group tagged- Closing the Capital Gap in Investing in Africa. We discussed closing the capital gap for fund managers in Africa and the challenges faced by African investments funds when they prioritize social impact alongside financial returns.

I am honoured to have been recognized by Empower Africa as one of the 30 extraordinary individuals who have played a pivotal role in fostering innovation, economic growth, and positive change across the African Tech Landscape.

I had the pleasure of joining Dream VC and its fellows on their Webinar tagged: Unlocking the Power of Boards. I shared valuable insights on maximizing the potential of boards at early stages of investment. From selecting independent board members to thinking long-term.

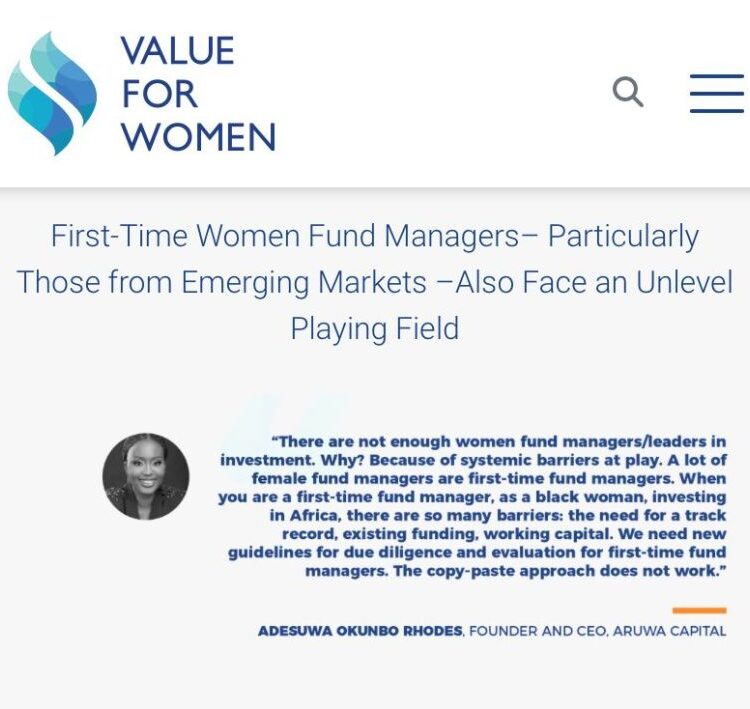

I am pleased to have been featured in the recent Value for Women Ltd. Series which was launched to mark its 10th year anniversary. I was featured in 4th issue of the series titled "Women Decision Makers" which centered on the need to intentionally channel more capital towards women decision-makers in emerging markets. I shared valuable insights, talking about the challenges women fund managers like me encounter in the investment field. I highlighted the systematic obstacles that exist, especially for first-time fund managers and also emphasized the importance of thinking outside the box when it comes to evaluating investments, instead of simply following the usual methods.

It was a pleasure to join John Coleman on the 156th Faith Driven Investor Podcast. The conversation was themed 'Investing in Women and Africa'. I shared my personal journey from investment banking to founding Aruwa Capital, our gender lens approach, and how we are empowering and inspiring women through our investments in female-owned and female-led businesses.

It was a pleasure to join Omolade Shonibare in an interview with Blackrock - the largest asset management company in the world with $9 trillion in assets under management. I discussed my career transition from investment banking to private equity and founding my own private equity firm - Aruwa Capital Management. We also discussed the challenges, risks, and opportunities associated with investing in Africa and how Aruwa Capital is changing the narrative and empowering women-owned and women-led businesses.

Following the week-long activities of the formal launch of the 100 Women in Finance Nigeria, we visited the Nigerian Exchange Group- NGX (formerly the Nigerian Stock Exchange) on Thursday 27th April. Amanda Pullinger, CEO, 100 Women in Finance alongside members of the 100WF Nigeria Committee met with key executives of the NGX to discuss their respective organisation’s missions and goals, as well as potential areas for collaboration. The highlight of the event was the striking of the closing gong by the 100WF team on the floor of the Nigerian Exchange to signify the end of stock trading for the day. We are thankful to all our hosts, sponsors, and partners for making our line-up of events a success. It is good to see great support from the media and organizations that are in alignment with the 100WF mission to promote the professional advancement of women in finance in Nigeria.

I had the pleasure of joining Saccoh Sidi and Esta Richard Etim on the 21st episode of The Pitch Room Africa as a guest speaker. The Pitch Room Africa is a Twitter space event that connects VCs, Angel Investors, Entrepreneurs, and Industry Experts together in meaningful and engaging conversations. I spoke on the topic- The Challenges of Gender Lens investing in Africa and shared practical tips on how female-led businesses can raise funds, and how Aruwa Capital is driving a change through our gender lens investment strategy.

I am pleased to have been a part of the formal launch of the 100 Women in Finance Nigeria location and also a member of the Founding Committee of 100WF Nigeria. Following the successful pre-launch events we organised last year; I am so proud that we were able to convince the global 100WF board to choose Nigeria as the 32nd location globally and 3rd African location. We held a celebratory dinner in Lagos to mark the launch, and it was graced by senior leaders within the Nigerian financial services sector. Amanda Pullinger, the Chief Executive Officer of 100 Women in Finance and Mrs Sola David-Borha, the former CEO, Africa Regions, Standard Bank Group gave the keynote addresses for the event. 100WF is set to deepen it’s reach to finance professionals across the banking, private equity, venture capital, and FinTech sectors, among others, in Africa. Their global network and programs will build a more diverse and gender-equitable finance industry in Nigeria by promoting diversity of thought, raising visibility, and empowering women to find their personal path to career success.