I am honoured to have received recognition from the Black YPO Group as one of the youngest female private equity fund managers to launch her own fund in Africa at just 29 years old. With less than 10 private equity funds owned or led by women in the entire continent of Africa, this year’s recognition from Black YPO group in celebration of International Women’s Day highlights the few success stories that have emerged from Africa and empower other women to stand up against gender inequality and strive for success.

I had the pleasure of speaking on one of the panels at the Nigerian Stock Exchange (NGX) International Women’s Day Webinar themed: Embrace Equity- Setting the Standard for a sustainable Future. I was on the Creating a Safe space for Women to Thrive panel moderated by Dr. Kemi Dasilva- Ibru, Founder WARIF, where I shared a bit about my journey from Investment banking to launching Aruwa Capital. I also highlighted the challenges faced by women raising funds for their business based on my experience as a female founder. The panel hosted great speakers from across various sectors- Kate Henshaw, Actress and Entrepreneur Nkechi Abiola, Founder-Lady Wheelers Association Chidinma Chukwueke-Okolo, Head Product Development- Nigerian Exchange Group and Dr. Dipo Awojide, Founder- BTDT Hub

It was a pleasure to be celebrated by Aruwa Capital as one of the 33 women across 24 funds that have successfully reached final close in Africa since 2008. With only 23 female-led funds in Africa that have reached final close since 2008, Aruwa Capital’s IWD publication was aimed at spotlighting 33 women who have shattered the glass ceiling that are role models for women everywhere in the fight for gender equity in critical sectors of the economy.

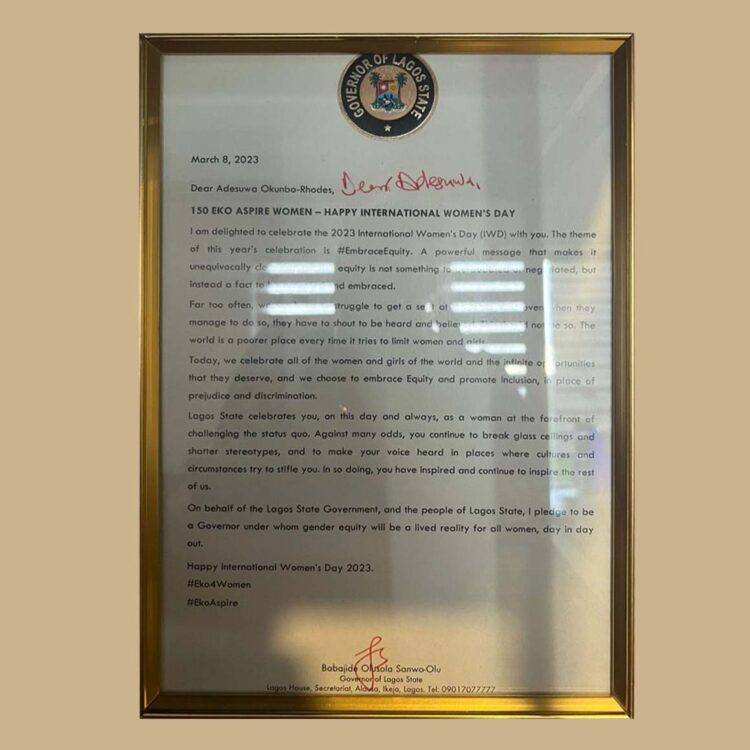

It was an honour to receive the Eko Aspire Women award from the Executive Governor of Lagos State Mr. Babajide Olusola Sanwo-Olu in celebration of International Women’s Day. I was selected as one of the 150 women recognized by the Lagos State Government at the forefront of challenging the status quo against many odds. This year’s IWD recognition by Lagos State is proof that the Governor of Lagos State acknowledges the struggle and discrimination women still face in the country today and restates his commitment to ensuring that gender equity is a reality for the woman and girl child in Lagos state.

It was a pleasure to be featured on Women Impacting Nigeria as one of the few female founders leading successful private equity fund in Nigeria. This feature highlighted Aruwa Capital as one of the few women owned and led private equity funds in Africa investing into untapped investment opportunities in West Africa in the small to lower mid-market.

It was great to attend the Faith Driven Investor Fund Manager gathering with over 50 managers across Africa. The event which held in Nairobi, was an amazing two days of learning, networking, and community building. It was also a good opportunity to meet with institutional investors from the United States interested in learning more about investing on the continent. I got to share our experience at Aruwa Capital Management and also my own journey over the last 12 years investing on the continent.

I had the pleasure of speaking on one of the panels at the Youths in Business Forum for 2023. The theme for this year’s forum was Prepare for funding. On the panel I shared some of the tips that helped me successfully raise a $20 million oversubscribed fund from a mix of local and international private and institutional investors alongside great speakers from across various industries- Dr. Ola Brown, Founder Flying Doctors Will Stevens, Consul General to the United States, Fehintolu Olaogun, CEO CredPal, Oyin Solebo, MD ARM Techstars Lab and Segun Cole, CEO Fund the Gap.

It was an honour to be invited for an interview with Mastercard Foundation Africa Growth Fund, where I discussed my bold ambitions for Aruwa Capital to not just be focused on Nigeria and Ghana but to become a pan-African fund impacting women and creating jobs in multiple African countries.

I am pleased to announce our 7th investment from Fund I. Aruwa Capital made a solely funded $2.5 million investment into Taeillo- an innovative, tech-enabled local manufacturer of mass market and premium Afrocentric furniture founded in 2018. Taeillo’s impressive founder Jumoke Dada is a solo female founder who has grown revenues by 12x since inception with very little external capital. We are glad to back African female founders and change the narrative for innovative female founders building on the continent who were only able to attract 1% of VC funding last year.

It was with overwhelming gratitude I announced the closing of Aruwa Capital’s first fund and also that I made history as the first female solo GP to raise an institutional first fund over $10 million in Nigeria. Aruwa was launched in October 2019, when I was 29 years old and heavily pregnant with my son. In that same year we completed our first investment despite COVID restrictions. We received a $4 million anchor investment from Visa Foundation, we also received investment from Mastercard Foundation Africa Growth Fund and FSD Africa Nyala Venture Facility, being the first investment by both of those initiatives respectively. Aruwa has an oversubscribed first fund raising more than our $20 million target. To date, the Fund has made six investments, committing over 45% of its capital into a diversified portfolio across critical and essential sectors.

I am honoured to be recognized as a Woman Giant in Africa by Engage Empower Educate Initiative, a platform that is empowering women and girls across Africa to live and be their best.

It was an honour to be featured on Empower Africa as an African Changemaker and recognized as a contributor to women’s empowerment and commitment to gender equality in private equity.

It was a great pleasure to attend the YPO Edge premier annual gathering. YPO hosts the world’s largest global leadership community of more than 32,000 chief executives, this year’s event which was held in New York is the first physical meeting since the year 2019. It was a pleasure to listen to the world-class array of speakers including Ray Dalio, Founder Bridgewater Associates. Eileen Gu, Freestyle Skier. Larry summers, President Emeritus Harvard University, Zhang Yiming, Founder TikTok. Scott Gallaway, Clinical Professor of Marketing, New York University. Stephen Colbert, Director RMR Group and Maria Ressa, CEO & Executive Editor Rappler.

It was an honour to be recognized as one of the Top 40 under 40 Black women in Asset Management award in the Alternative Investment segment. The BWAM 40 Under 40 List recognises inspiring and innovative professionals under the age of 40 who have shown leadership and demonstrated strong achievements in their careers.

It was a great pleasure to herald the expansion of 100 Women in Finance global locations to Nigeria alongside the 100WF Nigeria working group- Nieros Oyegun Soerensen, Partner and COO Verod Capital, Tariye Gbadegesin, MD/CEO ARM Harith Infrastructure Fund Managers (ARMIF) and Taiwo Okwor Vice President African Finance Corporation (AFC). The Nigeria location marks the 32nd location for 100WF and the third in Africa. Click here to get updates on 100WF Nigeria.

It was an honour to be listed as one of the ten women running multimillion-dollar businesses in male-dominated industries in Nigeria by Ventures Africa.

It was a pleasure to speak on one of the panels at the inaugural BWAM conference which held in London. My panel session: Views from the Top- Assessing the State of the Investment Landscape was moderated by Dawid Konotey-Ahulu, Co-Founder, Redington, Mallowstreet and 10000BlackIntern alongside my co-panelists - Eric Collins, CEO and Founding Member, Impact X Capital Partners, Stephanie Heller, Managing Partner, Bootstrap Europe and Wol Kolade, Managing Partner, Livingbridge.

I had the pleasure of moderating one of the panels at the inaugural PEVCA Nigeria annual conference with the theme: The Road Ahead- Private Capital for National Development. The panel -Unlocking Local Capital had accomplished speakers in attendance - Ozofu Olatunde Ogiemudia, Partner Udo Udoma & Bello-Osagie, Dave Uduanu, Managing Director Sigma Pensions Limited CFA, Mezuo Nwuneli, Co-Founder & Managing Partner Sahel Group and Dare Otitoju, Executive Director Stanbic IBTC Pension Managers.

It was a pleasure to join Jason Eaves, CEO, Discovered Markets and Pratap Raju, Founding Partner, Climate Collective Foundation on a podcast for SOCAP 2022 to discuss how a systems view of the market can highlight new investment opportunities, decrease inequity in investing decisions, and yield better financial returns.

It was an honour to be selected among the Top 100 young African leaders under the age of 40 set to play a major role in the economic development of the African continent by Institut Choiseul in the Choiseul 100 Africa 2022 ranking.

It was an honour to be invited by Kemi Ajumobi and BusinessDay alongside many great Nigerian Women to share my views on our dear country at 62.

I had the pleasure of moderating one of the panel sessions at the Annual Conference for Female Directors hosted by the Institute of Directors Nigeria. The panel tagged -The Female Agenda, What’s Next? covered discussions on some actionable plans to close the gender gap. We had powerful speakers in attendance- Fatima Wali- Senior Adviser, Stakeholder Relations, Dangote Group, Ivana I. Osagie- Founder & CEO, Professional Women’s Roundtable, Geraldine J. Fraser-Moleketi- Chancellor, Nelson Mandela University and Lansana WONNEH- Deputy Country Representative, UN Women.

It was great to be on the breakout session at the Women in Impact Summit with other investors. We shared insights on future-proofing private portfolio from an investor standpoint.

It was a pleasure to speak alongside other accomplished leaders from around the world at the Jellycorn Future of Impact Summit 2022, we discussed Shifting Capital - Female-led & Diverse Fund Managers in Action.

It was great to discuss with Chimgozirim Nwokoma from Techpoint Africa about how Aruwa Capital Management is closing gender funding gaps profitably and impacting society positively.

I and my siblings held a one-year memorial in honour of our father titled Lasting Legacy - the Key to Nigeria’s Development. The essence of the lecture, which will be a yearly summit, is to keep his legacy of impact alive. I was honoured to moderate a panel discussion which included other impactful speakers- Dr. Obiageli Ezekwesili, the former Minister of Education, Mr. Tonye P. Cole one of the Co-Founders of Sahara Group, Bishop Feb Idahosa, President of Benson Idahosa University and Mr. Orondaam Otto the Founder of Slum2School.

It was a pleasure to be on the panel for the MBS diversity day hosted by Mannheim business school. We had discussions around Finance, Diversity, Investing, Gender, African start-ups, and related topics.

It was a pleasure to speak on the panel and join other leaders across the African development community to discuss new ways to finance healthcare, education, and positive climate action at the Africa Social Impact Summit.

It was a pleasure to be hosted by the CEO of the British International Investment at a lunch roundtable where I shared my perspective on how BII can support emerging fund managers and female fund managers on the continent.

I had the pleasure of joining Kenneth Igbomor to share insights on a significant question in the African Economy of today. Can African start-ups sustain trends in venture capital funding?