A river cuts through rock, not because of its power, but because of its persistence

Adesuwa Rhodes is changing the face of investing and entrepreneurship in Africa one investment at a time

Adesuwa is a leading investment professional and CEO with over 14 years of experience in investment banking and private equity in developed and emerging markets across a number of sectors including healthcare, financial services, technology and consumer goods. Adesuwa is an entrepreneur, CEO, mother, investor and women’s empowerment advocate. She is one of the youngest female private equity fund managers running her own fund in Africa, having launched her fund at 29 years old. She is the Founder and Managing Partner of Aruwa Capital Management, one of the few women owned and led private equity funds in Africa investing into untapped investment opportunities in West Africa in the small to lower mid-market. Adesuwa is focused on using Aruwa Capital Management’s investments as a case study to make the business case to invest in women as fund managers, entrepreneurs, consumers and stakeholders in society. Adesuwa is a mission driven pioneer on a mission to unlock the power of private capital as a catalyst for change in her environment.

Learn More"I am on a mission to unlock the untapped potential of women as capital allocators, consumers, founders, board members, suppliers and across all levels of society, to unlock enhanced financial returns and positive social impact."

~ Adesuwa Rhodes

I was delighted to join a breakfast meeting in Lagos with the leadership team from British International Investment (BII), including Christopher Chijiutomi, Managing Director & Head of Africa, Benson Adenuga, West Africa Regional Director & Head of Office for Nigeria, and Adeola Ukoha, Coverage Manager, Nigeria. We shared updates on Aruwa Capital Management Fund II, including our team’s growth and the strong pipeline of scalable, impact-driven opportunities. Many of these opportunities align closely with BII’s concessionary debt facilities, supporting local SMEs that are driving meaningful change across Africa. Reflecting on our partnership, from my first email to BII in 2015 to collaborating on Fund II today, underscores the power of persistence and alignment in building inclusive and resilient private capital ecosystems across Nigeria and West Africa.

I had the pleasure of participating in the Africa Startup Festival 2025, joining a fireside conversation titled “Real People. Real Markets. Real Returns” alongside Temilola Adepetun (MD/CEO, SKLD) and moderated by Olalekan Onabanjo. The discussion offered an opportunity to reflect on the realities of scaling essential businesses across Africa. We explored how intentional investment in essential sectors- where demand is consistent, impact is measurable, and value creation is long-term, can drive inclusive growth. The conversation highlighted the importance of gender-smart, patient capital and the need for investors to remain close to operational realities to support sustainable business growth and resilient markets. Being part of this dialogue reinforced why Aruwa Capital’s approach- investing in businesses rooted in real market needs, continues to deliver tangible impact for communities and long-term value for investors.

I was honoured to deliver the keynote, “Performing With Purpose: Beyond Profit to True Impact,” at the PerformX Nexus Summit. The event, themed Building Bold, Executing Smart, and Performing Beyond, brought together industry leaders for inspiring keynotes and dynamic panel discussions. My keynote reflected on a journey guided by conviction, strategy, and purpose- showing that performance is not only about achieving targets, but about the impact those outcomes create for people, systems, and long-term transformation. Sharing the story of founding Aruwa Capital reinforced why purpose has always been central to our work: widening access to capital, challenging norms, and supporting inclusive leadership across Africa.

I am honoured to have been recognised at The Peak Perfomer Awards 2025, I won the TPP Under 40 CEO of the Year Award, recognising leadership impact, integrity, and contribution to industry and society. This award reflects the work we do at Aruwa- pioneering gender-lens investing, reshaping capital allocation in Africa, and consistently focusing on inclusive, long-term value creation. Aruwa Capital Management was also recognised as The Peak Performing Female-Focused Investment Company, celebrating our disciplined investment strategy, measurable impact across portfolio companies, strong governance, and efforts to elevate the private equity ecosystem across the continent.

I had the pleasure of meeting His Royal Highness, The Duke of Edinburgh, during his visit to Lagos to engage with employers of young people in Nigeria. We discussed Aruwa Capital Management’s work to expand opportunities for youth and women, including job creation and the development of inclusive local value chains. It was an opportunity to highlight the catalytic role of early partnerships, such as the Foreign, Commonwealth and Development Office’s investment through FSD Africa in Aruwa Fund I, which helped build our gender-lens investing track record and scale our impact. This engagement underscores the important role private capital can play in driving economic empowerment, and we look forward to continuing partnerships that unlock the potential of Nigeria’s next generation.

I had the pleasure of participating in the 7 Generations Institute’s Pan Africa Family Office Engagement Series, where we explored how African families can preserve generational wealth while contributing meaningfully to the economic development of their home countries. The discussions emphasised the importance of trust, relationships, and intentional planning within our local context, with valuable perspectives shared by industry leaders present.

I had the pleasure of joining ImpactAlpha’s Agents of Impact Call to discuss an important topic: catalysing local growth funds for Africa. Across sectors such as healthcare, education, agriculture, and financial services, growth businesses are driving real economic impact and creating jobs at scale. Yet, by our estimates at Aruwa Capital Management, Nigeria and Ghana alone face a $150 billion growth capital funding gap. The conversation highlighted a shared recognition among fund managers across Francophone Africa, Ghana, and Kenya of the need for: fit-for-purpose capital, creative liquidity solutions, local insights, technical assistance, and support to institutionalise businesses. As Drew von Glahn noted, local capital managers play a crucial role in the middle of the “hourglass,” bridging the gap between small firms and large-scale investment.

I am honoured that Aruwa Capital Management emerged as a triple winner at the 14th Annual Private Equity Africa (PEA) Awards Gala in London- a recognition that marks a truly memorable moment in our journey. I am especially humbled to receive the Person of the Year / People’s Choice Award for the second consecutive year. Voted by peers across the industry, this award reflects the shared recognition of our efforts to widen access to capital for women and underrepresented founders across Africa. Aruwa was also recognised as Private Equity House of the Year – Small Cap, reaffirming our belief that purpose and performance can coexist at the highest levels, and Overall Private Equity Portfolio Company of the Year for Yikodeen Company Limited, celebrating the strength of African manufacturing, job creation, and innovation. As we celebrate this moment, our focus remains on the road ahead, building the future of private equity in Africa, one purposeful investment at a time.

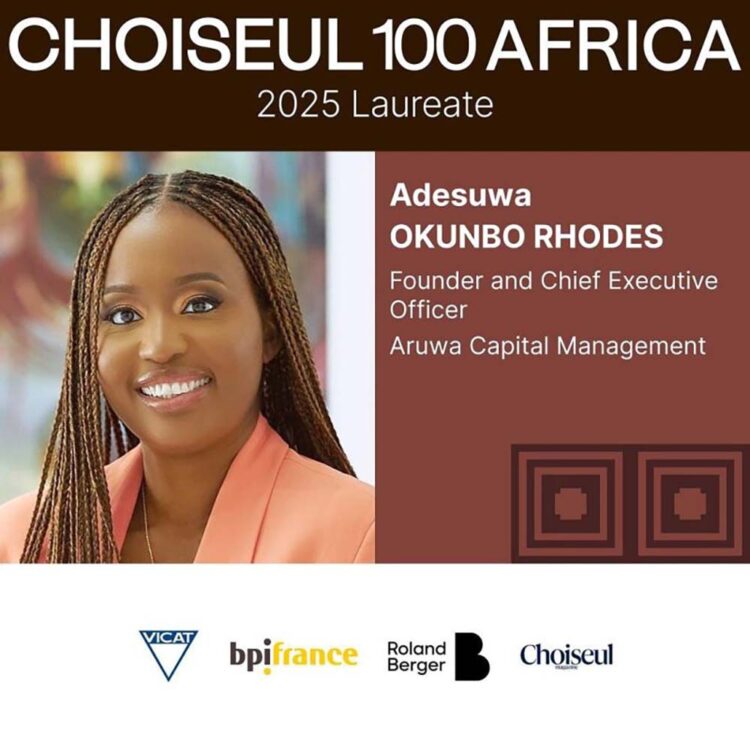

I am honoured to be recognised once again among the leaders of the Choiseul 100 Africa 2025, a ranking that highlights young African decision-makers under 40 who are contributing meaningfully to the continent’s economic, social, and cultural development. Since 2022, this recognition has been a reminder of the broader movement shaping Africa’s future, one that aligns closely with Aruwa Capital Management’s mission to expand opportunity, deepen inclusion, and support the growth of locally owned, female-led businesses across the region. Being named among this year’s Nigerian laureates, including a cohort of exceptional Nigerian women, reinforces the importance of consistent, values-driven leadership in building systems that deliver sustainable and inclusive impact for the continent.

I had the honour of attending the Ford Foundation West Africa’s 65th Anniversary celebration in Abuja, a reflective moment recognising the Foundation’s decades of work in advancing social justice, equity, and opportunity across the region. The programme underscored the importance of inclusive development and long-term partnerships in shaping resilient communities in West Africa. It was also a pleasure to meet Dr ChiChi Aniagolu-Okoye, Regional Director for West Africa, whose leadership continues to guide the Foundation’s impactful engagement in the region. As one of Aruwa Capital Management’s investors, the Ford Foundation has been an important partner since 2021. We remain aligned in our commitment to driving inclusive growth and expanding opportunity across West Africa.

"I believe the way to effectively provide women with more seats at the table is for us to create our own tables. More women succeeding as capital allocators means more women getting funded, more mentors, more torch-bearers, and more examples to follow. Investing in or with funds like Aruwa Capital Management is a practical way to narrow the gender funding gap and making money while you do so."

- Adesuwa Rhodes

Adesuwa is the Founder & Managing Partner of Aruwa Capital Management an early stage private equity fund investing in rapidly growing businesses in West Africa. With Aruwa Capital and her own personal investments, Adesuwa is focused on uncovering untapped investment opportunities that are typically overlooked and underserved. Adesuwa is passionate about showcasing the natural competitive advantage women allocating capital have when investing in businesses for women and by women. Through a gender lens investment strategy, Adesuwa is focused on generating enhanced financial returns whilst delivering positive social impact with a multiplier effect across societies and economies.

Learn More